This is something I wanted to do as time passes; there’s a need in me to provide evidence of accountability in the things I do when there’s the possibility of me … ‘cheating’ to look like things are going better than they actually are. This activity would be more to fool myself more than anyone else but it can’t hurt to have folks who are interested follow along with my progress. I’ll be adding an entry at the end of each month, if not more often, to celebrate my successes and discuss my failures.

As such, I’m including an image of my Chartlog journal for the month of March 2022. This shows my results in a calendar format. See that below.

As you can see. it was a decent month but definitely had it’s ups and downs. I ended the month with an account increase of $530 which is not the amount I was hoping for. Let me explain….

When I decided I was going to pursue this experiment, the idea would be to increase my account while gaining experience intraday trading. By increasing my account, I’d be able to keep my risk ~ 2% of my account maximum while increasing that risk dollar value thereby allowing me to increase the number of shares I could buy. It’s all connected. LoL

I built out a spreadsheet that I’ve shared here previously that outlined a 2% daily increase in my account; it was a bit of wishful thinking because it did NOT take into account the large red days you sin in the calendar above. This was a gargantuan miscalculation on my part and something I’ve since rectified through re-calculation.

The idea that I would have NO red days was foolishness at the least and sheer hubris at it’s worst. As I gain more experience in this, and consume more content related to intraday trading, I realize that losses are a part of the process but the idea is that you want to control the size of your losses. I truly screwed that up several times this past month.

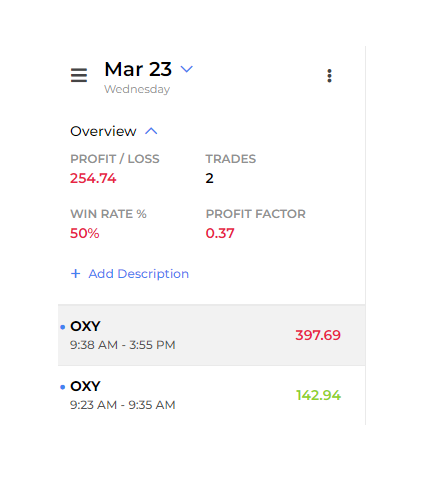

On the several large loss days, I picked a direction that I thought the stock I was looking at would go and then either went short or long. Many times during that second week, I just didn’t want to be wrong and waited for the stock to turn around and go my way. And I paid for it, literally, in cold hard cash. I’ve included a screenshot of my Chartlog entries from March 23 below.

I took two trades this day: the first was a profitable trade that I squeezed $142.94 out of. Pretty good trade but it reminds me that I was probably risking more than my usual amount if we managed to pull 142 out of the trade. It infers that I was risking $70 on that trade which is WAY too much for my meagre account size. However, it sort of explains why we got hammered so hard on the second trade of the day.

The second trade is embarrassing to acknowledge; very quickly into the trade, it turned and started losing value. And something kept me from getting out. I kept telling myself it was going to turn around and go back up. It has to turn around and go back up! I’ve included a link to the trade so you can have a look at the chart and see how much of an idiot and in denial I was.

I’m going to leave it at that as I’m already into April and haven’t done as well as I would like. More closer to the end of the month.